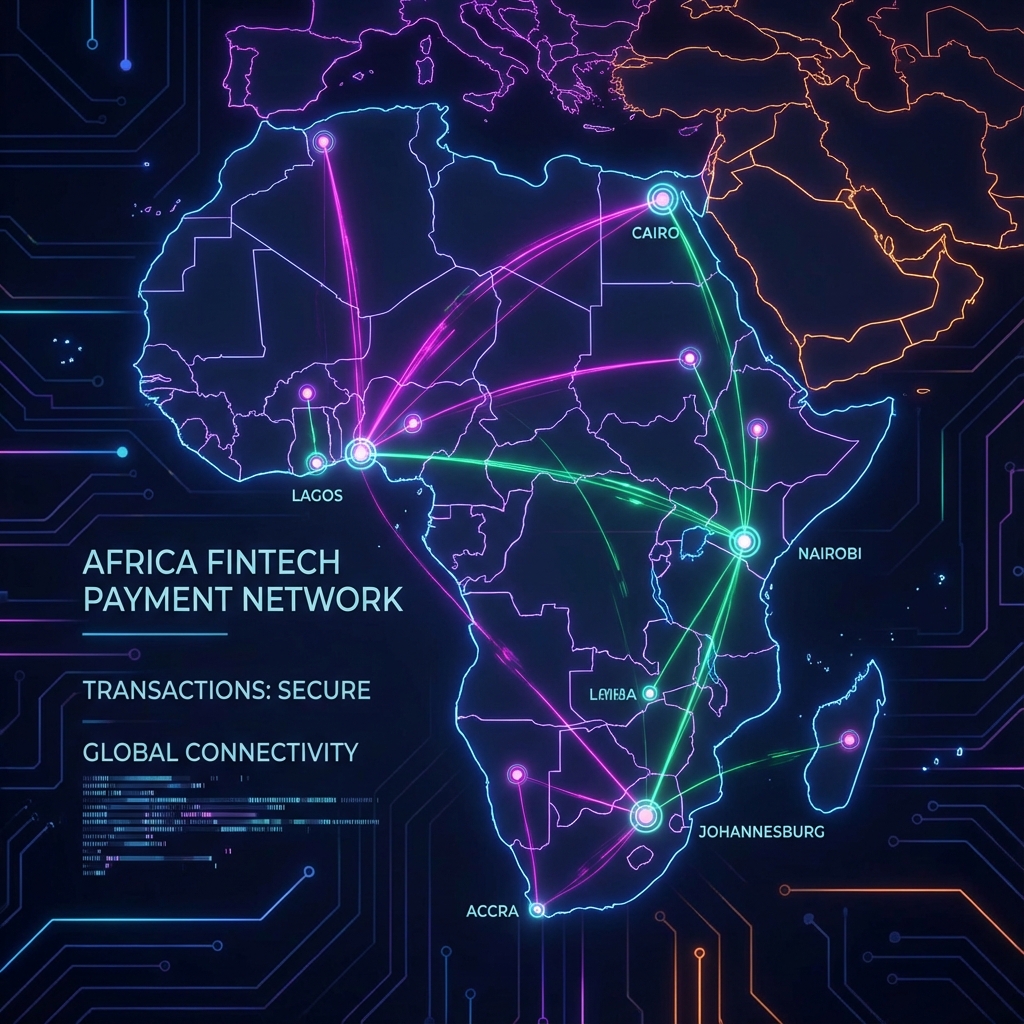

Payments built for

Africa.

Accept payments, manage multi-currency wallets, and scale globally. Secure, fast, and completely seamless.

Built on Trust & Security

Your security is our priority. We meet the highest standards in payment security.

PCI-DSS Ready

Fully compliant with global payment standards

Bank-Grade Encryption

End-to-end encryption for all transactions

Built for Business

Scalable infrastructure for any size

Our Products

A complete ecosystem for African commerce and finance.

See how it works

Lightning-fast payment processing from customer to merchant

Customer

Zurapay

Merchant

Get started in 3 easy steps

From signup to your first payment in minutes, not days.

Create Account

Sign up in minutes with just your email and business details.

Verify Business

Quick KYC verification to ensure trust and compliance.

Start Accepting Payments

Integrate our API or use our no-code solutions to start earning.

Why choose Zurapay?

Built by Africans, for Africans. Ready to take your business global.

Built for Africa

Optimized for African payment methods, currencies, and infrastructure.

Fast Settlements

Get your money in 24 hours or less. No waiting weeks for payouts.

Developer-Friendly

Beautiful docs, SDKs in multiple languages, and responsive support.

Scales Globally

Start in Africa, expand worldwide. Multi-currency support built-in.

Accept payments on WhatsApp

Meet your customers where they are. No app downloads, no friction.

Zurapay

Online

Hi! I'd like to purchase the Premium Plan

10:30 AMPayment Successful!

Transaction ID: ZRP-2026-001

10:31 AMAccept payments directly in WhatsApp. No app downloads required.

Start accepting payments today

Join 10,000+ businesses already using Zurapay to grow their revenue

No credit card required • Setup in 5 minutes